PDF(826 KB)

PDF(826 KB)

PMCMC for Term Structure of Interest Rates under Markov Regime Switching and Jumps

Xiangdong LIU, Xianglong LI, Shaozhi ZHENG, Hangyong QIAN

Journal of Systems Science and Information ›› 2020, Vol. 8 ›› Issue (2) : 159-169.

PDF(826 KB)

PDF(826 KB)

PDF(826 KB)

PDF(826 KB)

PMCMC for Term Structure of Interest Rates under Markov Regime Switching and Jumps

A parameter estimation method, called PMCMC in this paper, is proposed to estimate a continuous-time model of the term structure of interests under Markov regime switching and jumps. There is a closed form solution to term structure of interest rates under Markov regime. However, the model is extended to be a CKLS model with non-closed form solutions which is a typical nonlinear and non-Gaussian state-space model(SSM) in the case of adding jumps. Although the difficulty of parameter estimation greatly prevents from researching models, we prove that the nonlinear and non-Gaussian state-space model has better performances in studying volatility. The method proposed in this paper will be implemented in simulation and empirical study for SHIBOR. Empirical results illustrate that the PMCMC algorithm has powerful advantages in tackling the models.

PMCMC / term structure of interest rates / state-space models / regime switching / jumpdiffusion {{custom_keyword}} /

Table 1 The comparison between APF and PF under N |

| N | 500 | 1000 | 2000 | 5000 | 10000 | |

| APF | M-error | 0.251 | 0.250 | 0.249 | 0.248 | 0.245 |

| M-loglik | 714.881 | 714.895 | 714.890 | 714.885 | 714.896 | |

| Sd-loglik | 0.169 | 0.115 | 0.079 | 0.058 | 0.036 | |

| PF | M-error | 0.252 | 0.249 | 0.249 | 0.246 | 0.246 |

| M-loglik | 714.835 | 714.867 | 714.876 | 714.885 | 714.880 | |

| Sd-loglik | 0.407 | 0.266 | 0.181 | 0.111 | 0.081 |

Table 2 Estimation via PMCMC |

| α1 | α2 | β1 | β2 | σ1 | σ2 | p | q | ||

| True | 0.02 | 0 | 0.5 | 1 | 0.05 | 0.02 | 0.7 | 0.7 | |

| APF | Mean | 0.0222 | 0.0024 | 0.487 | 0.926 | 0.044 | 0.0241 | 0.620 | 0.760 |

| SD | 0.0070 | 0.0021 | 0.158 | 0.056 | 0.0045 | 0.0032 | 0.128 | 0.093 | |

| PF | Mean | 0.0228 | 0.0027 | 0.476 | 0.921 | 0.0456 | 0.0255 | 0.599 | 0.779 |

| SD | 0.008 | 0.0028 | 0.187 | 0.073 | 0.0054 | 0.0035 | 0.160 | 0.131 |

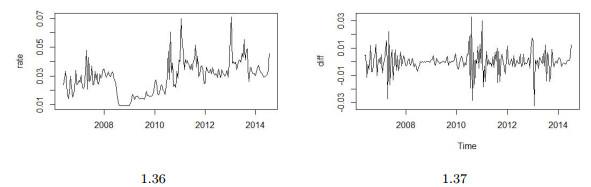

Figure 3 Historical trace and first-order difference of SHIBOR with maturity 7 days |

Table 3 Historical trace and first-order difference of SHIBOR with maturity 7 days |

| Mean | SD | Maximum | Minimum | Skewness | Kurtosis |

| 0.0291 | 0.0113 | 0.0711 | 0.0093 | 0.4972 | 0.9482 |

Table 4 Estimation via PMCMC |

| Regime 1 | α1 | β1 | σ1 | γ1 | λ1 | μ1 | η1 | p |

| Mean | 0.0127 | 0.5332 | 0.0542 | 0.5699 | 0.3274 | 0.0122 | 0.0056 | 0.8765 |

| SD | 0.0038 | 0.1034 | 0.0126 | 0.0824 | 0.1987 | 0.0061 | 0.0013 | 0.0494 |

| Regime 2 | α2 | β2 | σ2 | γ2 | λ2 | μ2 | η2 | p |

| Mean | 0.0005 | 0.9474 | 0.0540 | 1.0770 | 0.5315 | 0.0015 | 0.0037 | 0.9174 |

| SD | 0.0003 | 0.0214 | 0.0127 | 0.1044 | 0.1319 | 0.0009 | 0.0005 | 0.0303 |

| 1 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 2 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 3 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 4 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 5 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 6 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 7 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 8 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 9 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 10 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 11 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 12 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 13 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 14 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 15 |

Zeng Y, Wu S. State-Space Models applications in economics and finance. Statistics and Econometrics for Finance, Springer, 2013.

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 16 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 17 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 18 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 19 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 20 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 21 |

Rios M P, Lopes H F. The extended Liu and west filter: Parameter learning in Markov switching stochastic volatility models. Chapter 2, in this volume, 2013.

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 22 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 23 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 24 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 25 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 26 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 27 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 28 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 29 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| 30 |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

| {{custom_ref.label}} |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

PDF(826 KB)

PDF(826 KB)

Figure 1 Trace plots, scatter plots and ACF of the parameters

Figure 1 Trace plots, scatter plots and ACF of the parameters  Table 1 The comparison between APF and PF under N

Table 1 The comparison between APF and PF under N Figure 2 Trace plots and ACF of parameters for PF and APF

Figure 2 Trace plots and ACF of parameters for PF and APF Table 2 Estimation via PMCMC

Table 2 Estimation via PMCMC Figure 3 Historical trace and first-order difference of SHIBOR with maturity 7 days

Figure 3 Historical trace and first-order difference of SHIBOR with maturity 7 days Table 3 Historical trace and first-order difference of SHIBOR with maturity 7 days

Table 3 Historical trace and first-order difference of SHIBOR with maturity 7 days Table 4 Estimation via PMCMC

Table 4 Estimation via PMCMC Figure 4 Trace plots, histograms and ACF of

Figure 4 Trace plots, histograms and ACF of /

| 〈 |

|

〉 |